We are here to help you!

No limit on the amount of money that can be transferred via Net banking. But according to the guidelines, funds transferred via UPI are limited to Rs 1 lakh.

According to SEBI guidelines, we do not accept payments from unregistered bank accounts.

That’s unfortunate to hear that your funds are not reflected in your trading account.

Please send us a query at @contact.

That’s unfortunate to hear that you can’t add funds using UPI.

Please send us a query at @contact.

That’s unfortunate to hear that you haven’t received the funds for failed transaction.

Please send us a query at @contact.

That’s unfortunate to hear that you are unable to transfer funds via net banking.

Please send us a query at @contact.

Upto 5 minutes – UPI Payments / Google Pay

Upto 15-30 minutes – Net Banking

Upto 3 hours – NEFT / RTGS

Transferring funds through registered bank accounts is required by regulatory guidelines and compliance standards.

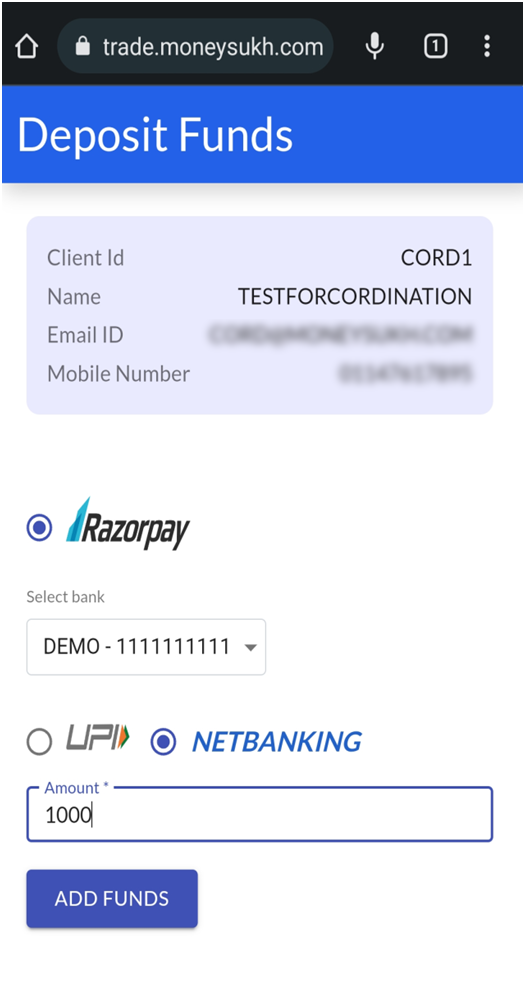

How to add funds ?

- After you login to Moneysukh application , tap on ‘Available Funds’.

- Tap on Add Funds

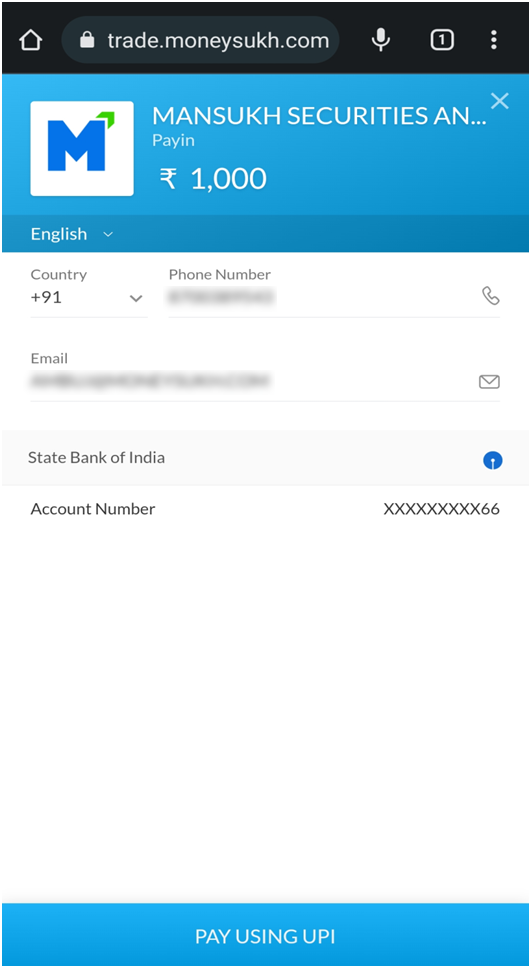

- Payment gateway page openend ‘trade.moneysukh.com’. Decide the mode of payment .You Can either add money through UPI or Net Banking

- After tap on ‘Add Funds’ Complete the transaction using UPI or Netbanking (The Screenshot below shows UPI )

- Once the transaction has been completed .Come Back to the Moneysukh application .

- You have successfully added money on Moneysukh Balance .

You may start investing Now!

For any further assistance please feel free to call us at 9638238000 or send us an email at support@moneysukh.com.

The following factors may cause a delay in the reflection of funds:

- Time taken by your bank to process the NEFT / RTGS / Virtual Mode transaction

- Incomplete or incorrect information submitted to us.

We recommend that users add funds using UPI or Net Banking payment methods for quick fund transfer

Possible causes of fund transaction failures:

- Your bank account is not responding / is responding slowly to our transaction processes.

- Transaction timed out due to authentication (password / OTP) delay

- Invalid Password

- You do not have enough money in your bank account.

- Fund transfer via third-party bank accounts

- UPI transfers made using unregistered bank accounts

- Q.How to add funds ?

- Q. What is the maximum amount of money I can deposit into my Moneysukh account?

- Q. Is it possible to deposit funds into my Moneysukh account from an unlinked bank account?

- Q. Why aren't my funds reflected in my trading account?

- Q. Why can't I add money using UPI?

- Q. What happened to my refund for the failed transaction?

- Q. Why am I unable to transfer funds via net banking?

- Q. How do I deposit money into my trading account?

- Q. Time required for funds to be reflected in a trading account.

- Q. Registration of a bank account for transferring funds

- Q. Delay in funds reflection when added through NEFT / RTGS / Virtual Mode in my demat account

- Q. Common reasons for Transaction Failure via Online methods