We are here to help you!

The Electronic Delivery Instruction Slip, or e-DIS, is a service that allows you to sell shares even if your Power of Attorney has not been submitted (POA) with your broker.

Please note that now you can sold any stock without POA/DDPI enablement through E-dis facility.

Kindly go through the below process flow to avail this facility:

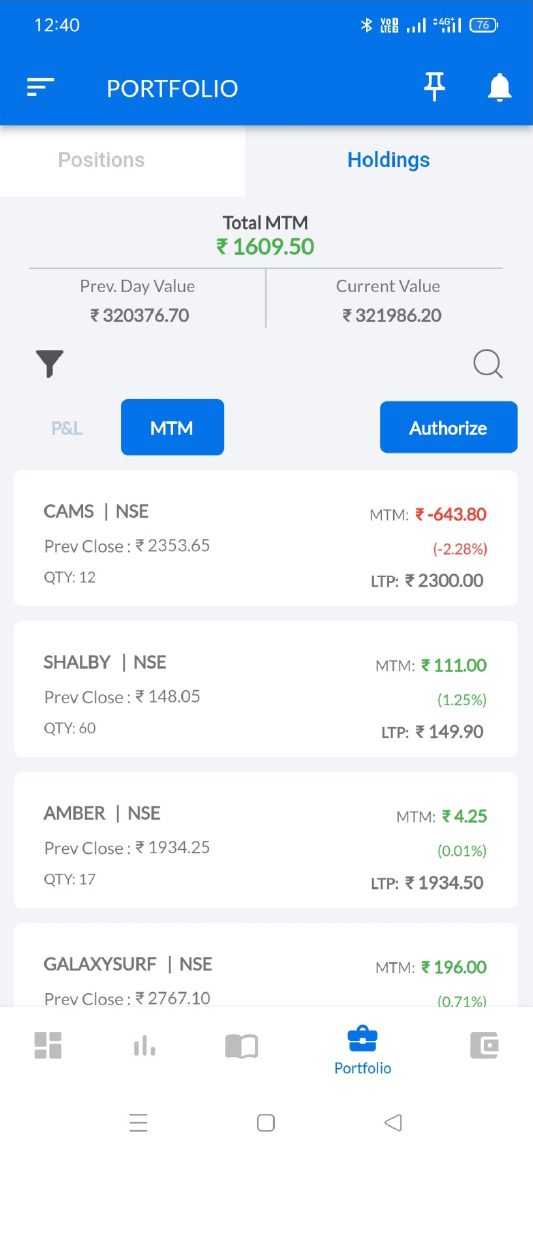

Go to Portfolio tab on Mobile App and click on Holdings

1.) Click on Authorize

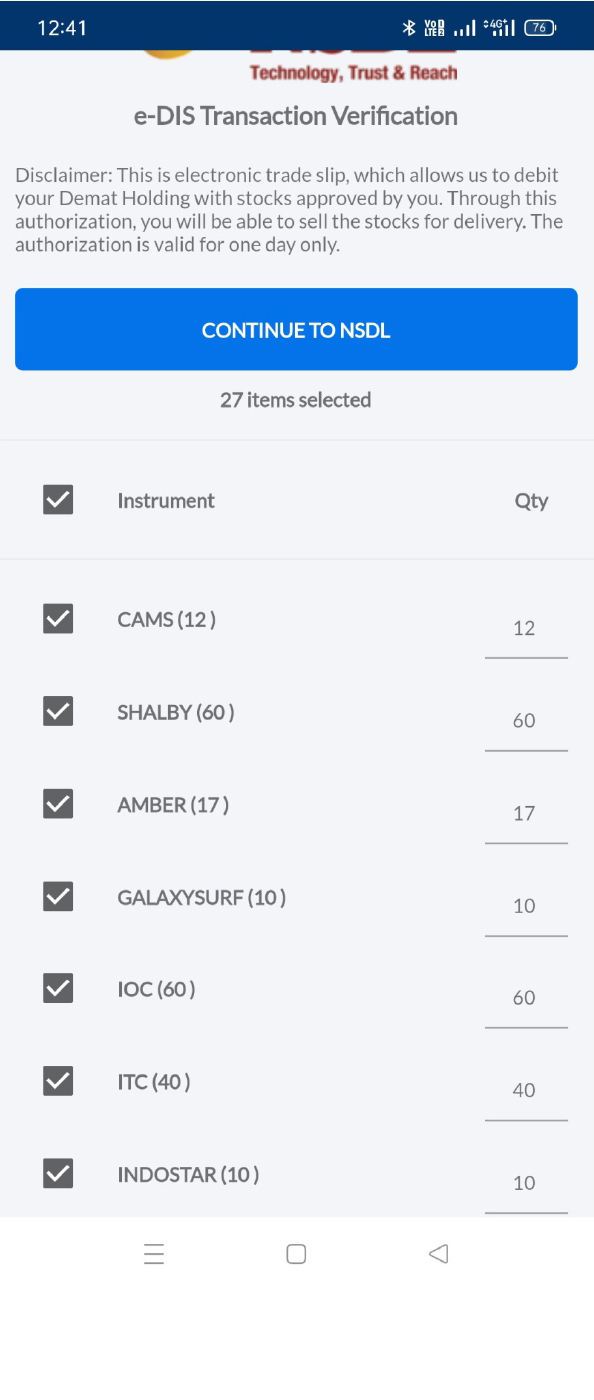

2) Click on CONTINUE TO NSDL

3) Enter your 6 digit PIN which you will receive in your first login and click on SUBMIT

4 ) Scroll down the screen , Click on T&C for Clients and Enter the OTP send by Depository to your

Mobile No and Registered Email id

Now you can sold any stock available in your Demat account after completing this process .

Please note that on every day you need to do so for selling any stock

e-DIS applies only to delivery-based transactions involving shares in your Demat account.

Authorization is simply a declaration of the scrips and the quantity that you wish to sell within a certain time frame. You retain the right to sell only a portion of the equities or not to sell at all, even after authorization has been granted.

No, you must first authorise your holdings before you can execute a sell transaction. Scrips will not be available for purchase unless specifically authorised.

EDIS is only valid for one day.

In the capital markets, the delivery instruction slip (DIS) is a vital document. When an investor wishes to sell or transfer securities from their demat account, the transaction must be authorised with a DIS. In most online trades, the client grants the broker power of attorney (POA) to debit the demat account against sale orders. This simplifies your life because you no longer have to worry about your DIS being rejected. In offline trades, however, you must still provide a signed DIS to the broker. The seller must fill out the slips because they are requesting a debit from their account. It can be used to transfer securities such as stocks, bonds, REITs, InvIts, Etfs, and so on.

- The ISIN number of the stock may be incorrect.

- There could be a typo in the number of shares.

- Both market and off-market transactions may have been labelled as the other.

- A signature mismatch is possible.

- The seller’s Demat account may not have enough shares.

- The DIS can be overwritten.

Off-market exchange of securities between two parties

Giving securities to a friend or family member.

Transfer of securities from multiple demant accounts to one selected account

Pledge of securities to your broker or bank in for loan.

For the first booklet you need to send an email to support@moneysukh.com and we will dispatch the same to your registered mailing address

- Q. What is e-DIS ?

- Q. I am unable to sell stocks from my demat account (NSDL)?

- Q. I am unable to sell stocks from my demat account (CDSL)?

- Q. Is e-DIS also useful for intraday transactions?

- Q. Is it necessary for me to sell the entire authorised quantity within the time frame specified?

- Q. Can I sell first and then authorise?

- Q. What is the maximum number of days for which I can authorise E-DIS?

- Q. What is DIS request?

- Q. Reasons for DIS rejection.

- Q. Where can a DIS slip be used?

- Q. Where can I obtain a Delivery Instruction Slip (DIS) booklet?