We are here to help you!

(steps and link for buying)

(link and steps)

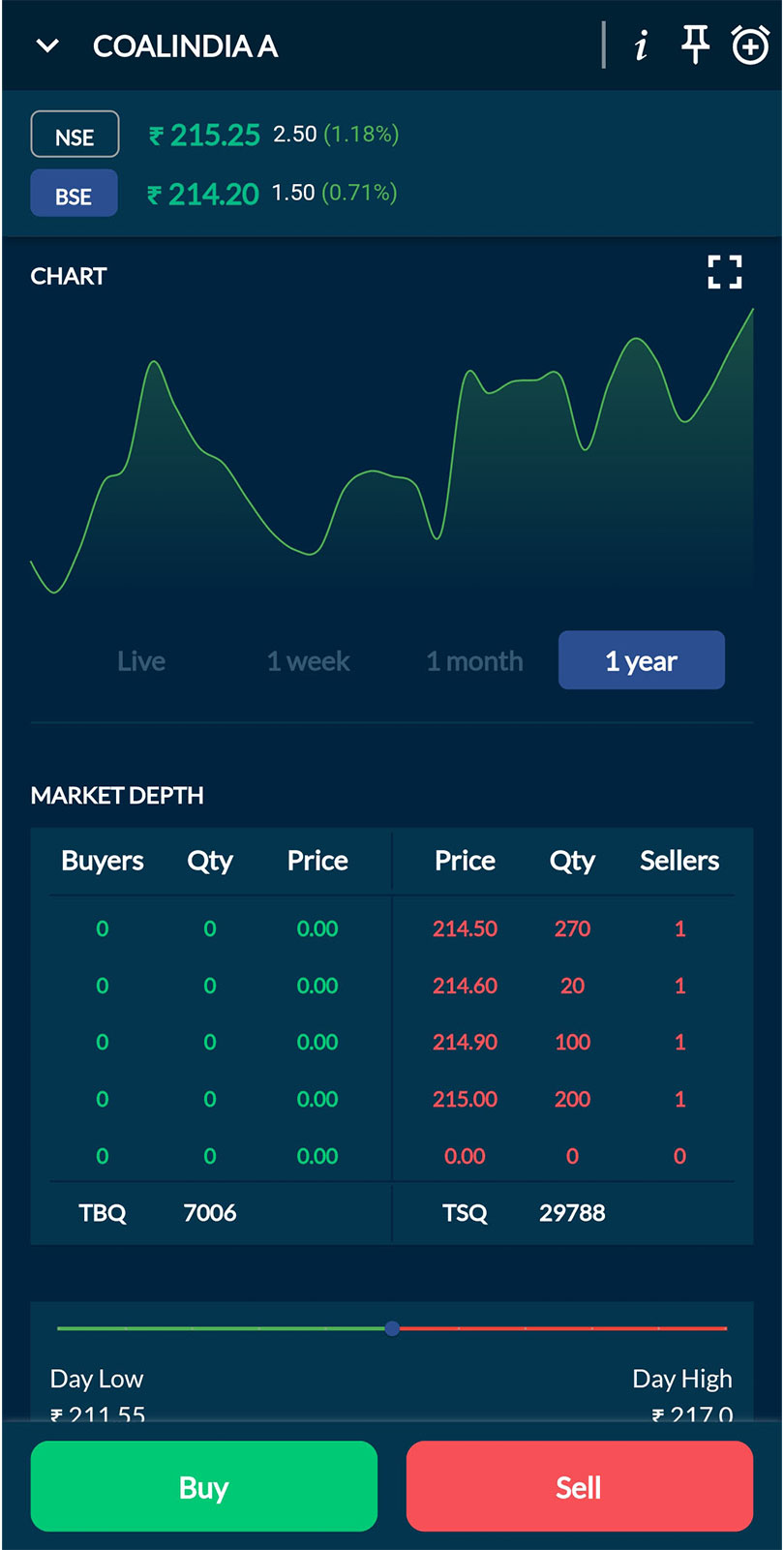

Placing an order via Moneysukh app is very simple and can be done with just a few taps. You can do this from Moneysukh mobile application.

Follow these steps to place an order:

Click on the stock you want to place an order from the watchlist.

Click on Buy or Sell to place an order

You will get an order entry screen.

Enter quantity and click on Buy or Sell to place an order

Order has been successfully placed.

How to fill Order entry:

-Mention the quantity you want to order.

-Select Order Complexity as ‘Simple’.

There are four types of Order, ‘Market, Limit, SL Limit, SL Market’

Product: There are two types of product, ‘Intraday and Delivery’.

Intraday trading, in simple words, in buying today and selling today. Buying and selling have to occur within one trading session on the same day. For example, a trader buys a stock XYZ for Rs 100 at 9:25 AM and sells XYZ for Rs 102 at 12:45 PM. The intraday profit will be 2 percent.

Delivery Trading is a system of trading that provides an opportunity to invest in stocks over the short term (more than 1 day) or long term. Delivery Trading essentially implies that you take ‘delivery’ of the ‘trades’ you make.

Validity: There are two types of validity, IOC and Day.

IOC in Moneysukh stands for an Immediate or Cancel (IOC) order. Such orders are either executed immediately or fail which are cancelled. A partial match of the order, if available, can be executed with the remaining order getting canceled.

For example, if you place an IOC order for 100 shares and only a price match for 40 shares is available then the order for 40 shares will be placed while the rest 60 shares will be canceled.

Day order is valid till date and the order will be executed anytime the price match is available.

For example, if you place a Day order for 100 shares and only a price match for 40 shares are available then the order for 40 shares will be placed while the rest 60 shares will be on open and if the same rate comes in the market again your order will be placed.

With a disclosed quantity order, you can declare only a portion of the total order that you want to buy/sell.

Once the disclosed quantity is specified, the order is sent to the exchange, and only the disclosed portion

is displayed on the market screen. The disclosed quantity should be neither equal

to nor greater than the order quantity, nor less than 10% of the order quantity.

- Q. Where can I check my account balance?

- Q. How can I buy / sell stocks?

- Q. What should I do to convert my intraday position into delivery.

- Q. How to place a stop loss order?

- Q. How do I make changes in my existing order?

- Q. How to buy and sell stocks through Moneysukh app?

- Q. What is a disclosed quantity order?